Challenges in the D&O market - a Sisyphean task?

07 Nov 2022 by Jonathan Watson

The term Sisyphean describes a task that is impossible to complete. We’ve all heard the story. Sisyphus was banished to the underworld and forced to roll a boulder up the hill repeatedly for eternity. It's not often that Greek Mythology and D&O cross paths, but the story of Sisyphus does feel familiar. IQUW's Gary Lill and Elisabeth Groehe explore the latest D&O market trends and the risks of an accelerated market softening.

A snapshot of the current market

Following five years of increasing security class actions which peaked in 2019, the rate of filings reduced in 2020 and 2021 and again in the first half of 2022. However, these figures only provide one side of the story. Significant rate increases in the public D&O market followed between 2018 and 2021 after the culmination of many years of challenging market conditions combined with a record rate of SCA filings between 2017 and 2019. However, it's been widely reported that, since the beginning of 2022, rating philosophy seems to have taken a worrying turn with existing and new capacity setting ambitious income targets for 2022 driven by buoyant IPO and SPAC markets over the preceding three years.

In 2022, this increased market capacity, combined with the retraction of the capital market appetite for IPOs and SPACs, has seen a downward pressure on pricing and retentions, the speed of which is unprecedented. As D&O underwriters, the questions we should be asking ourselves are simple: we all talk about sustainability, but how sustainable is the current direction of pricing and what factors must be considered to prevent a repeat of the recent dislocation in the market?

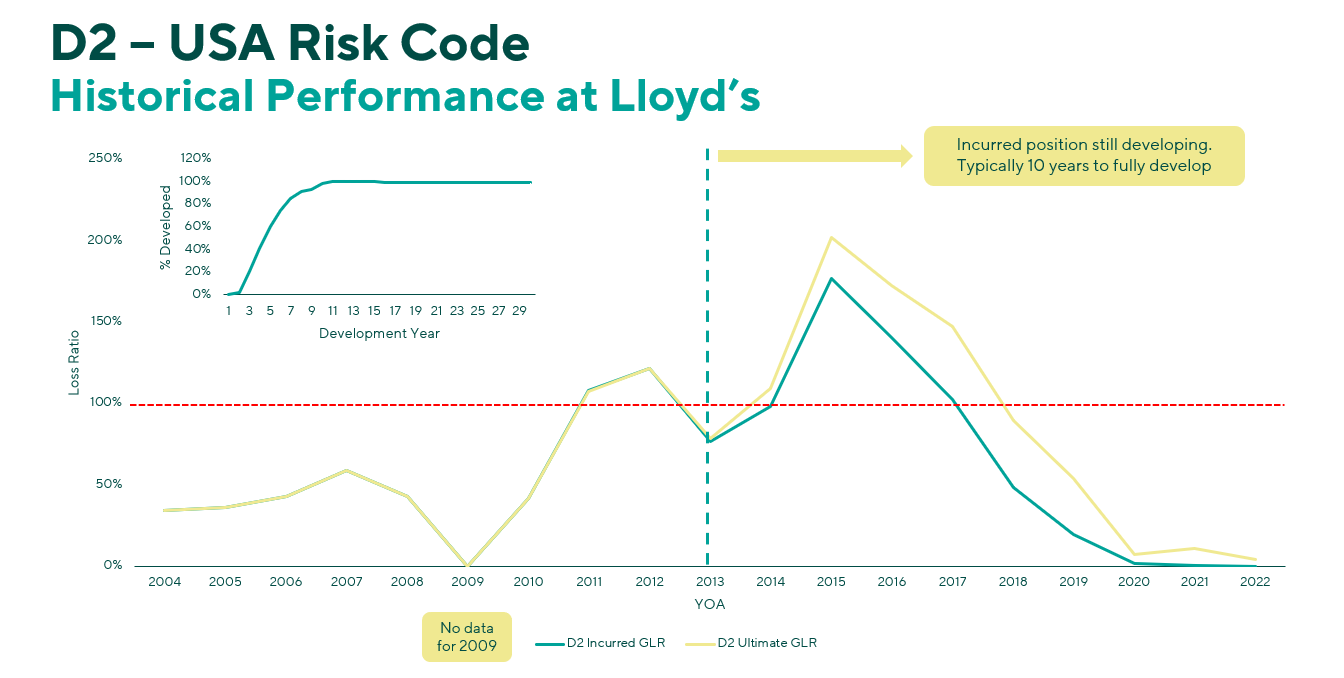

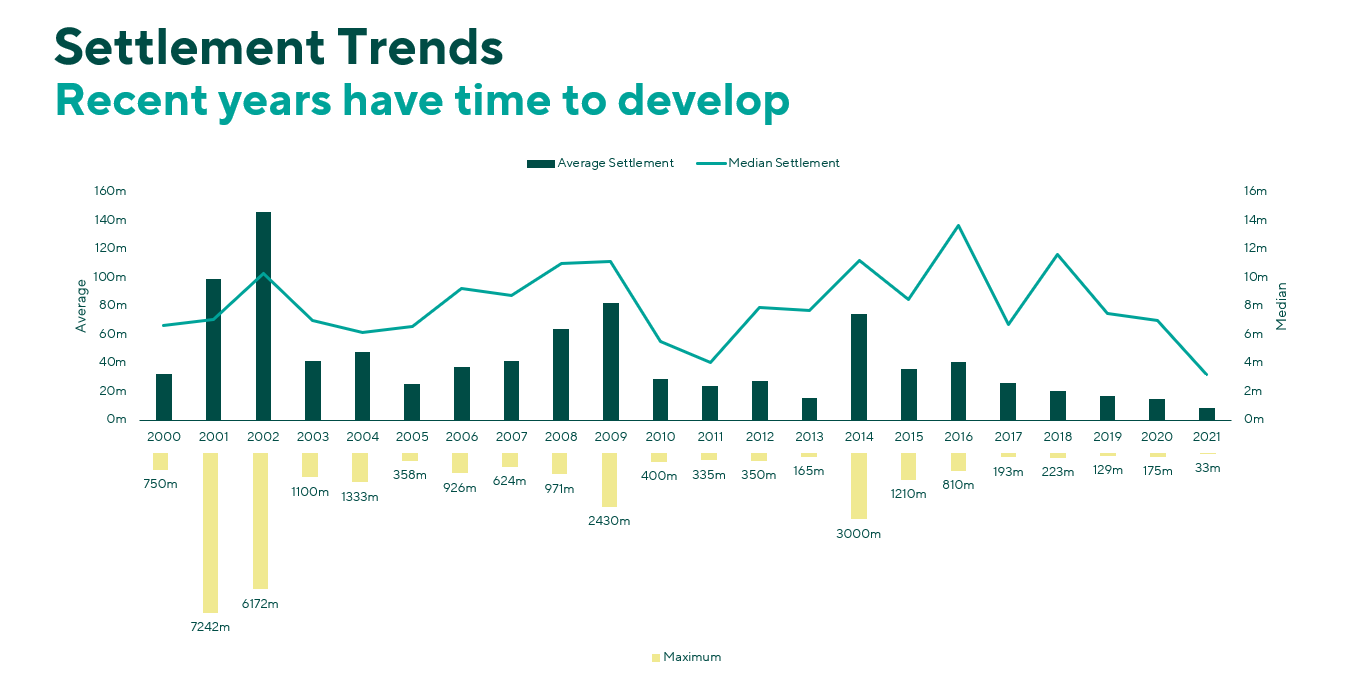

To set the scene, we have been looking at some additional factors which we believe support restraint in the current trend of rate reductions. For example, looking at the Lloyd’s triangles for USA Commercial D&O, the incurred position for those years is still developing. This is further evidenced by the recent announcement regarding the strengthening of D&O reserves by one of the domestic market leaders. Typically, it takes ten years for claims to fully develop. In conjunction with the latest Cornerstone Report (H1 2022), which demonstrates that the maximum dollar loss (MDL) of defendant’s market capitalisation has sharply increased, a wider picture emerges of how we might expect the trend to play out over the next five to ten years. The first half of 2022 has seen a record MDL figure of $1,573 billion which, according to Cornerstone, is more than triple the semi-annual average from 1997 to 2021. To provide some context, the S&P 500 index has grown approximately 56% over the past five years until January 1, 2022, which will drive the increase in MDL amount over this period of time. In simplistic terms, expected settlement dollar amounts are likely to go up.

Claim reserves remain hard to set and subject to significant inflation pressure

Historically, SCA settlement values represented 2-4% of the market cap drop, and in more recent years which have yet to fully develop, these trends appear to hold true. However, our observation is that the uncertainty around increased inflation and legal costs, which are yet to fully manifest in a number of open class actions, will likely impact settlement values. Will this range hold in the future?

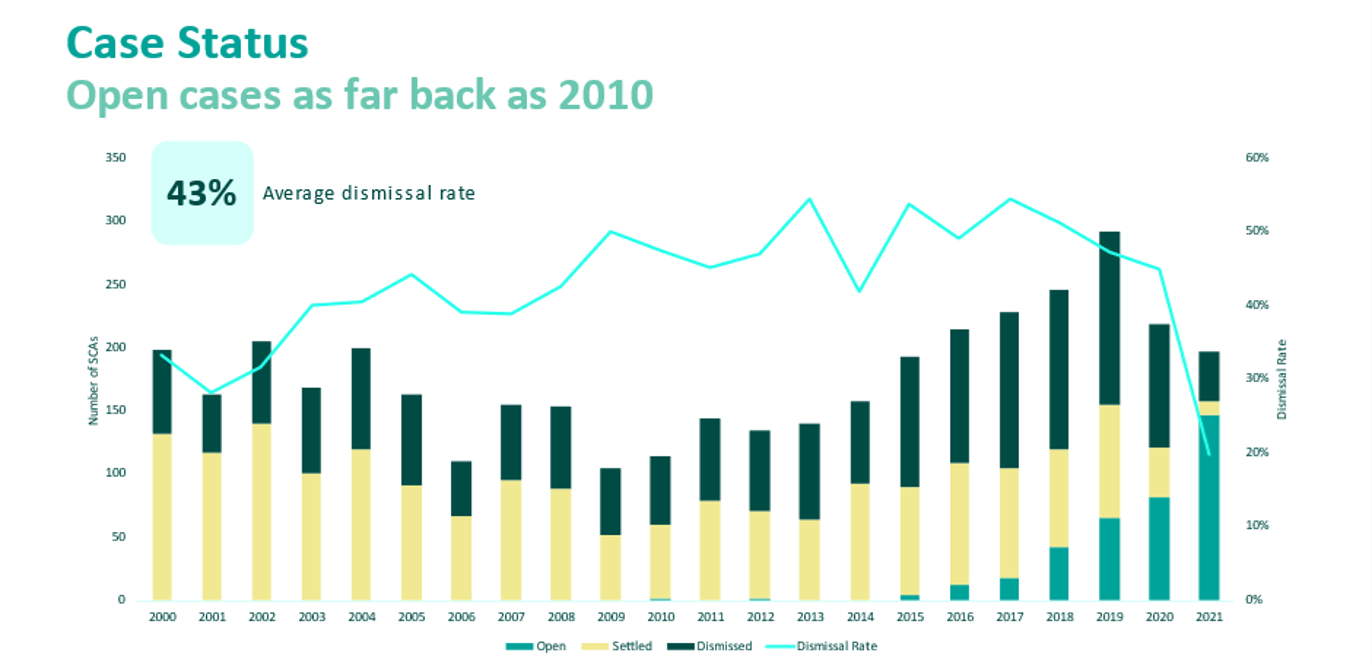

There is still a significant inventory of SCAs, derivative actions and regulatory investigations to play out. Many insurers are still reserving and paying losses from these historical years, including 2017 to 2019 when SCAs hit their peak. This phenomenon will continue into the foreseeable future. According to Stanford Securities Litigation Analytics data, some open cases date back to 2010, further lengthening the tail, and there will be challenges for insurers to appropriately reserve for inflationary pressures.

The macro-economic environment - continued challenges for Directors and Officers

The world is navigating an extremely challenging macro-economic environment with Covid hangovers, supply chain dislocation, decades high inflation, rapidly-increasing interest rates and the outbreak of the conflict in Ukraine. This year, the S&P 500 Index has fallen by the most in decades (19%), and the tech-heavy Nasdaq has seen a 28% drop since the beginning of the year, as investors and companies grapple with these challenges. This market downturn has manifested itself in the maximum dollar loss of $1,573Bn in the latest filings of H1 2022. Thus far, many companies have found a relative balance to these challenges, however the uncertainty of how long we can expect the macro-economic environment to continue to pose significant challenges to directors and officers of publicly-listed companies gives us reason for concern.

In recent months, numerous reports and articles have cited the significant fall in SCAs. While the number of overall filings (including M&A) have seen a considerable reduction from peak years, the number of core filings has remained relatively static. Comparing the peak period of class actions filed through 2021 and H1 2022, there is not a concomitant proportion of reduction in numbers. Previous core filings are 214 (2017), 238 (2018), and 267 (2019). At a count of 105 SCA filings at H1 2022, we could see them reach 2017 levels in 2022.

Back to Sisyphus.

There is more than a passing resemblance of the D&O insurance market of the past four years to the Greek myth in which Sisyphus arduously pushes the rock up the hill, and once achieved, has it roll right back down to the bottom, at which point he has to start again. A vicious cycle. In 2022, we have seen market conditions move in a direction which may rapidly put us at the bottom of the hill, much faster than expected. Considering the above concerns and historical trends, combined with a very uncertain economic environment which could well see an increase in loss frequency, a common-sense approach to underwriting is paramount to avoid a repeat of the severe contraction of available capacity seen over the last four years.

Learn more about IQUW's Directors and Officers Insurance product