D&O market: flying close to the sun?

07 Dec 2023 by Gary Lill

Last year we published an opinion piece comparing the challenges faced by D&O insurers and brokers to a Sisyphean task. One year later, continuing the Greek mythology theme, it might be more appropriate to compare the state of the current market to the story of father and son duo Daedalus and Icarus, which exemplifies the rise and fall of a human due to ambition, hubris, and defiance of limitations. It is this defiance, metaphorically speaking, that could lead to some insurers falling from the sky and drowning.

A year on – the market today

D&O insurance continues to be an indispensable facet of risk management for public companies globally to attract talent. Focusing on the US, in a litigious society, executives and board members regularly find themselves entangled in allegations of misconduct, mismanagement, or other wrongdoing. Following a reduction in filings of Securities Class Action (SCA) in 2021 and 2022, 2023 is on track to see a 15% year-on-year increase, according to the latest Nera Report.

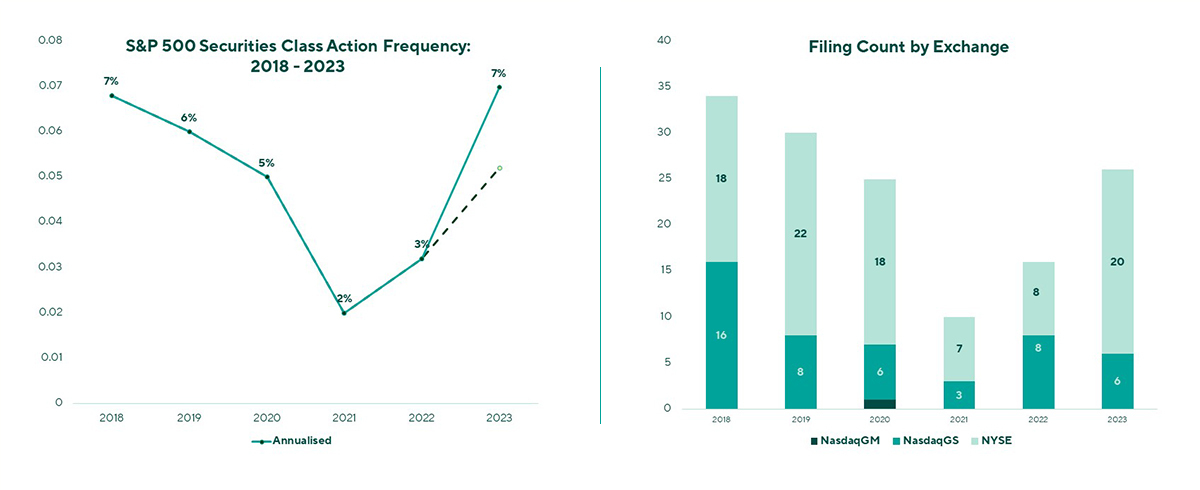

This is just one interesting statistic on the changing D&O exposure landscape. Our analysis suggests that, in relative terms, the number of core filings (stripping out merger related filings and factoring in the reduction in publicly traded companies) is on course to increase by 25% in 2023. We should also consider that we are on course to see a record 7% (35) of the S&P 500 be the target of a Securities Class Action in 2023. While in isolation that does not sound overly concerning, if you consider average limits purchased by these constituents ($150m), and dismissal rates (circa 50%), then the total potential settlement exposure is well in excess of $2Bn for this segment alone for 2023, compared to more than $1.2Bn in 2022.

Whilst we have not yet seen an increase in litigation arising out the changing economic landscape, including the increase in US business bankruptcy filings in 2023 (+30% vs 2022), we do believe that the impact of the rise in interest rates since April 2022 is baring its teeth, particularly as companies undergo refinancing of debt which now materially costs more. The harsh reality is that we will see an increase in SCAs as a result of companies encountering financial difficulties. If you then factor in two or three large-scale corporate scandals of a similar scale to Enron, Worldcom and Tyco (not unfeasible for those that remember) the impact on our market could be explosive. Furthermore, the threat of a recession in a number of economies in the next 12 months remains very real and if it does materialise then it will likely result in an increase in litigation, implicating both D&O and FI.

As if that were not enough to contend with. The war in the Middle East and continuing war in Ukraine has heightened geopolitical uncertainty which impacts economic stability. We also need to factor in the increase in ESG-related litigation and enforcement action, especially around disclosures made pursuant to changing SEC rules, as Orrick Herrington & Sutcliffe lawyers note here on the Harvard Law School Forum on Corporate Governance. Cyber remains high on the risk agenda for D&O’s and their insurers, especially with the recent increase in ransomware attacks after a post Covid reduction and concerns around a systemic event are very real. The list goes on…

Despite these risks, the D&O market has experienced a fast-paced decline in rates over the past two years, with some insurers aggressively defending and chasing new business by reducing rates and retentions, increasing line size and widening coverage, and brokers aggressively restructuring programs and pursuing new business to replace lost revenue – just one big feeding frenzy. This has attracted some very public criticism from senior figures in the market, which has shone an unflattering – albeit at least partially justified – light on some of the underwriting decisions being made.

That said, it does feel like some green shoots are sprouting and that we may see some stability returning. There has been increasing speculation that the current market trend is unsustainable and that rates in some instances are close to inadequate levels again. If this continues at the current pace, we will see rates rise again. There is added speculation that some insurers are curtailing their underwriters ability to agree to rate reductions and the prior year tail is starting to wag.

However sentiment and emotion play a significant part in market cycles and until underwriters fully realise that they are incurring losses then unfortunately in the short term we see no change in direction. While we do not expect the same level of decreases in 2024 that we have seen over the last two years, we expect to still see a very competitive market.

So back to Greek mythology. Daedalus created wings of feather and wax so that he and his son, Icarus, could escape imprisonment in King Minos’ Labyrinth. However, Icarus failed to heed his father’s warnings about flying too close to the sun and crashed into the sea when the wax on his wings melted.

The myth serves as a cautionary tale that is pertinent to today’s D&O market. It emphasises the dangers of overreaching and ignoring the benefit of experience, previous market cycles and current trends. It also underscores the significance of balancing ambition with wisdom and humility. Underwriting in a challenging market takes skill and patience especially in this market environment. At IQUW we utilise cross functional expertise and data to continue to build a balanced and sustainable portfolio, which enables us to be smarter in our decisions, as we try to be more Daedalus than Icarus.

Icarus and Daedalus can serve as a moral compass for navigating the turn in market conditions over the last two years. In the quest for personal growth and achievement, humans are often encouraged to reach for the skies – and underwriters for ever greater market presence - but Icarus' fate serves as a reminder that such endeavors should be tempered with a clear understanding of one's own limitations.

Find out more about Directors and Officers at IQUW here or speak to Gary.